SHARE

Christmas may be right around the corner, but 2021 is a different year for British retailers and customers alike.

Pandemic fears remain; the government has recently tightened restrictions, and Christmas shoppers have more buying options than ever before, with eCommerce evolving exponentially during COVID-19.

Here at Webhelp, we conducted a survey in partnership with YouGov to analyse consumer buying behaviours and preferences leading into the holiday season, in order to understand the issues that are most concerning to consumers and retailers this Christmas.

We surveyed over 2,000 UK adults to explore the importance of brand loyalty, considerations between offline and online shopping, and the value of personalisation, and uncovered a few key trends that should matter to retailers – in particular, leaders who are focused on customer experience, operations, and organisational transformation.

Here are some of the key insights gathered from the results:

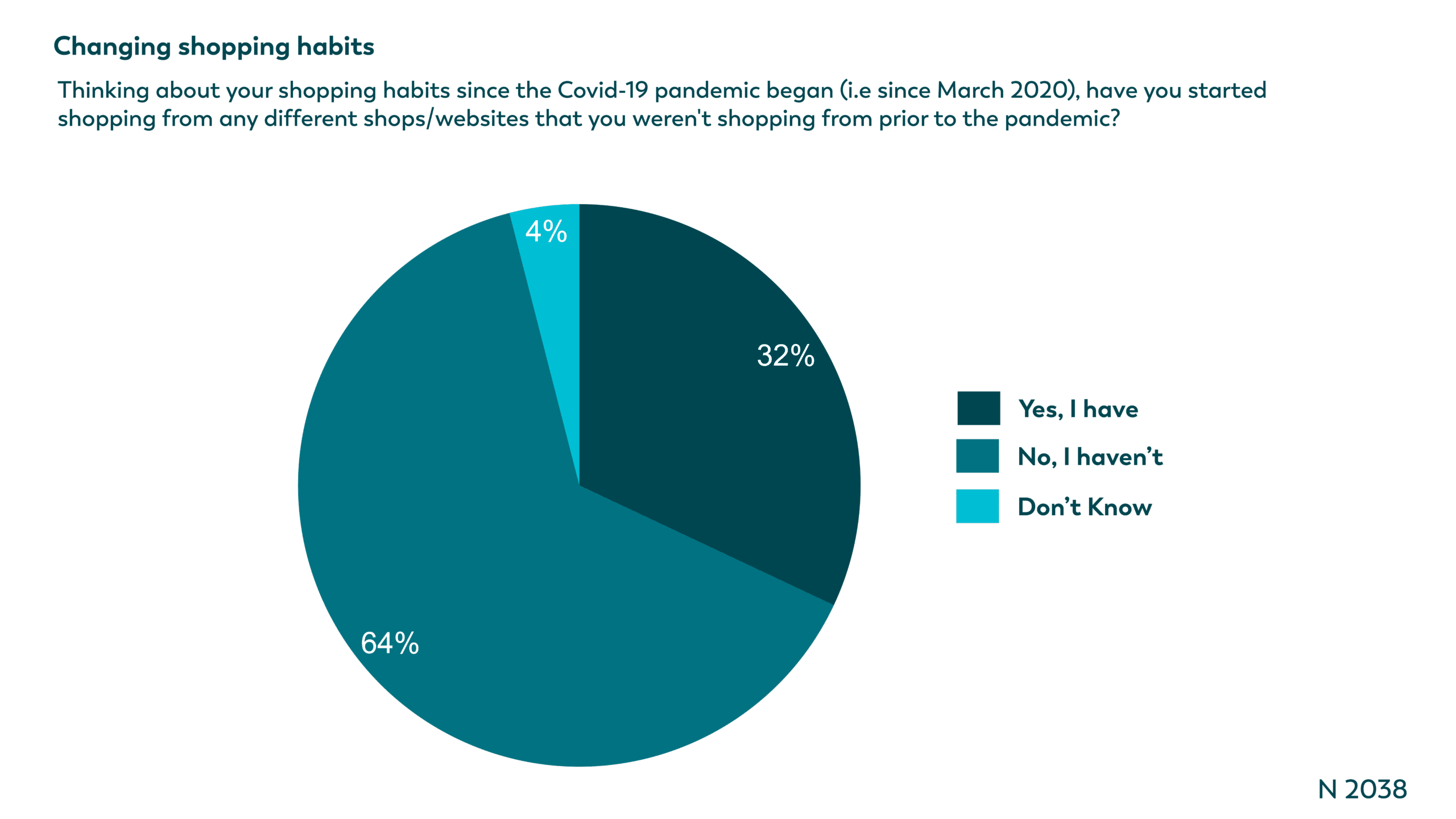

- The pandemic could be impacting loyalty and causing customers to look beyond their usual brands – almost one third of those surveyed have started visiting different shops or websites that they weren’t using prior to the pandemic (32%), with value for money the most popular reason.

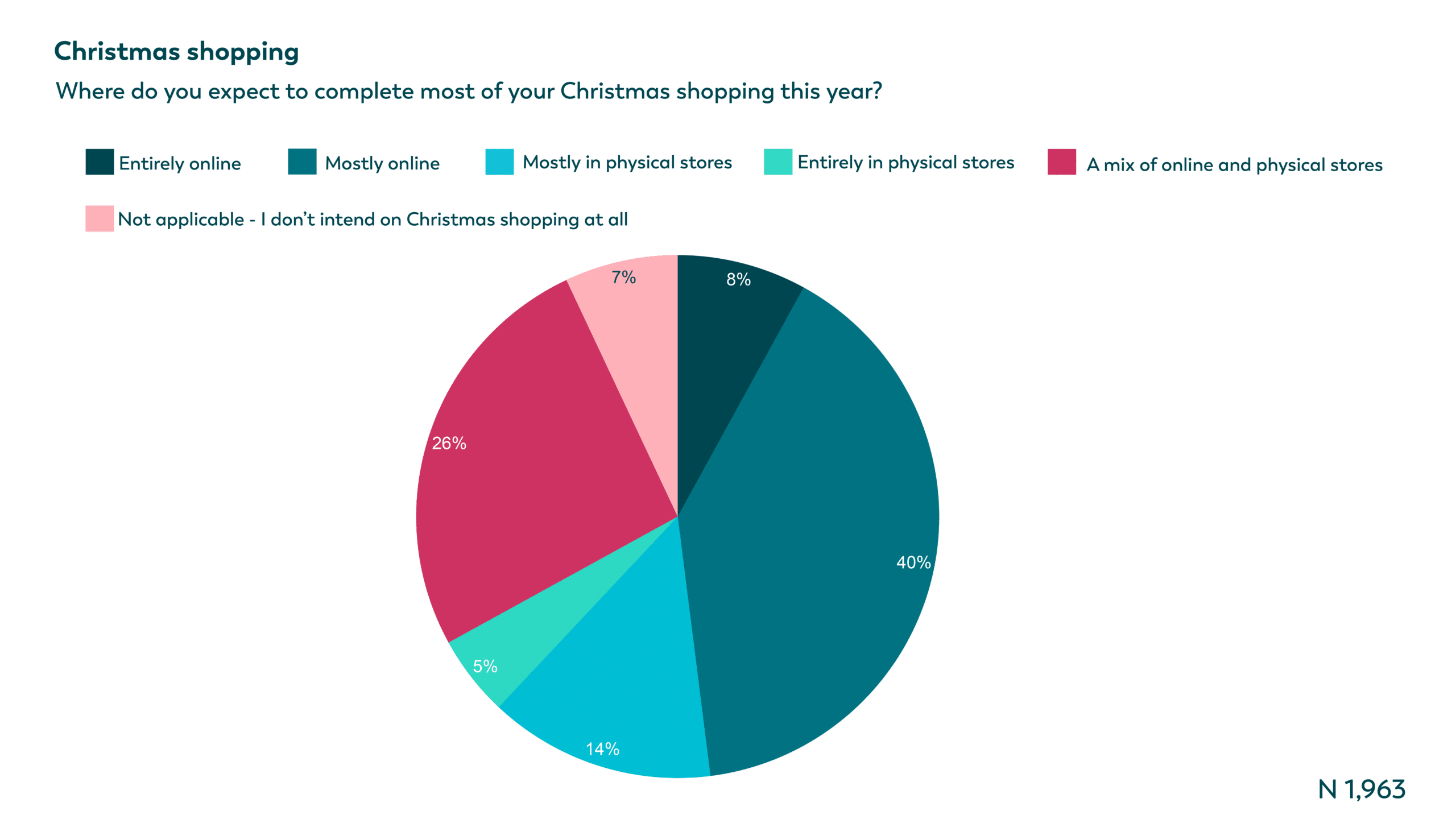

- Online retains dominance with almost 48% of shoppers planning to shop mostly or entirely online.

- There’s still hope for the high street however, with 46% of shoppers strongly agreeing that it’s an important part of British life, and over one third planning to shop in store.

- There’s an opportunity for retailers to improve personalisation with all age groups – half of those aged 18-24 feel retailers do this well, but this drops consistently across each group to just 22% for those aged over 55.

Money matters – value drives decisions

We first looked at what influences people when they decide where to do their Christmas shopping.

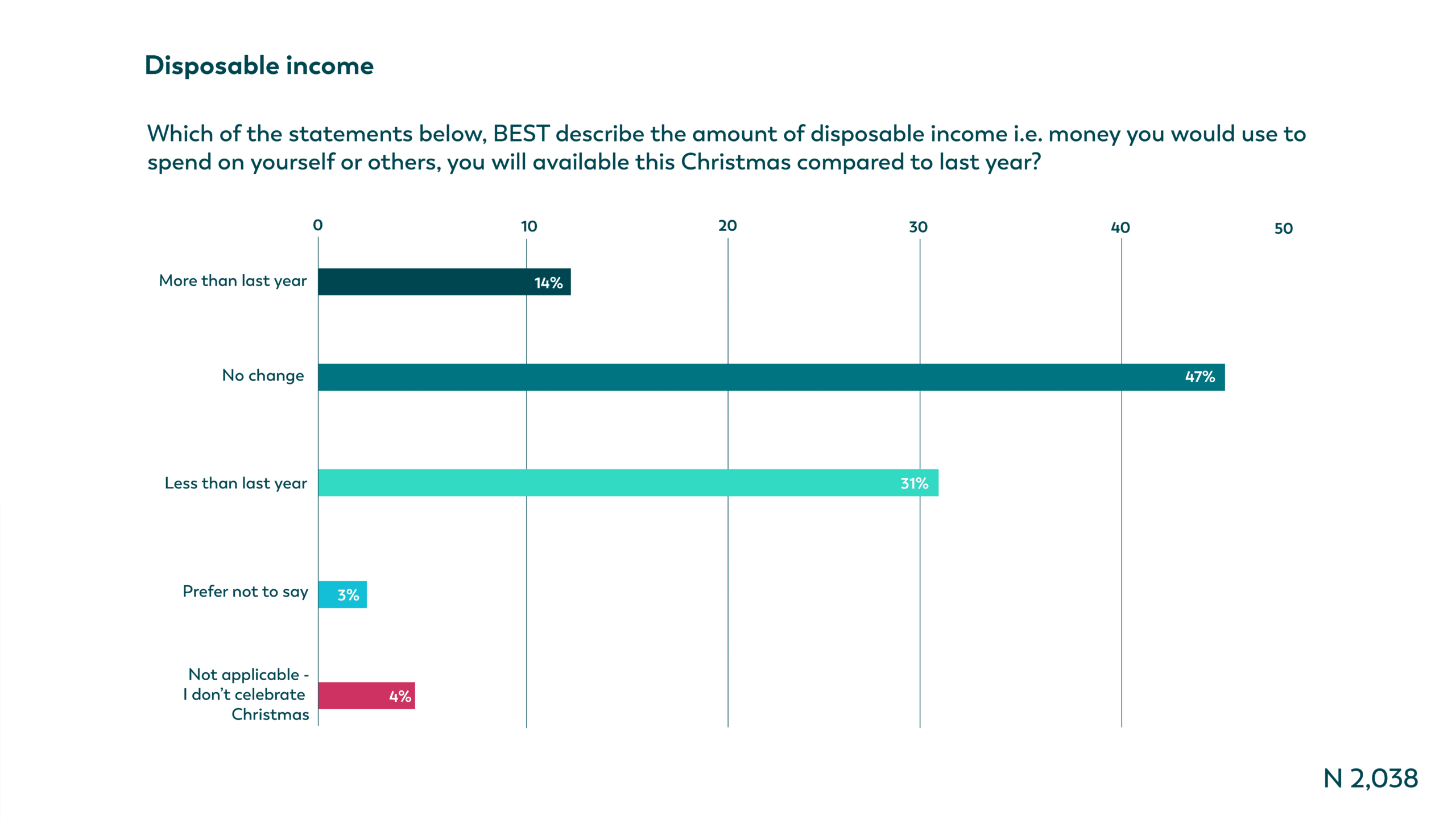

Perhaps unsurprisingly, financial considerations are the primary motivation for most people – almost one third (31%) felt they had less disposable income than last year. Value for money is the main deciding factor (60%), followed by low prices and promotions (40%) and cheap shipping and delivery costs (35%).

Fast delivery times are equally as important as positive customer reviews, with 33% of respondents stating that this feedback influences their buying decisions.

“Perhaps unsurprisingly, financial considerations are the primary motivation for most people.“

Customers want to get behind local businesses, with 35% planning to support local businesses this year. Moreover, 57% plan to start shopping at the same time they did during previous years, with 22% planning to hit the stores earlier — a significant enough number of customers to warrant enhancements to existing customer journeys, both online and offline.

Brand loyalty is under pressure

One interesting trend is that the pandemic could be causing customers to look beyond their usual brands.

Almost one-third of surveyed consumers (32%) have started visiting different shops or websites that they weren’t using prior to the pandemic, primarily driven by the same financial considerations as their more loyal counterparts.

“Almost one-third of surveyed consumers (32%) have started visiting different shops or websites that they weren’t using prior to the pandemic”

For this 32%, value for money was the most popular reason for jumping ship (39%), followed by prices and promotions (34%) and cheap delivery costs (27%). Over a quarter (27%) also counted fast delivery times and the opportunity to support local businesses as their reasons for switching brands, while 24% were influenced by positive customer reviews, emphasising the importance of getting the end-to-end customer journey right.

Online shopping continues to dominate…

With Amazon only one click away and continually pushing the boundaries of customer convenience, the importance of getting online retail experiences right is more vital than ever. Almost half of the shoppers surveyed (48%) plan to shop mostly (40%) or entirely (8%) online.

“Almost half of the shoppers surveyed (48%) plan to shop mostly (40%) or entirely (8%) online.“

Moreover, 14% of respondents expect to have more disposable income to spend this Christmas than last year, while 47% expect to have the same budget.

With many shoppers choosing to purchase online, some with more cash to spend, retailers have an opportunity to increase revenue by enhancing their personalisation efforts and improving customer experiences in online purchase journeys.

Retailers appear to be relatively successful at personalising interactions with younger customers, with 51% of 18-24 year olds agreeing that the deals and promotions they receive often feel tailored to their needs. Comparatively, this percentage drops continually across the various age brackets in the survey, with only 22% of over 55s feeling this way. It’s clear therefore, that as retailers look at their immediate and overall 2022 priorities, there is huge opportunity to improve personalisation across all age groups.

…but there’s hope for the high street

Here’s some good news for bricks-and-mortar retailers – there could be a revival of high street shopping, albeit against the ongoing backdrop of the pandemic.

We asked customers to respond to the statement that local high streets are an important part of British life, of which 46% strongly agreed, and 37% somewhat agreed. Age did factor into these results, with the over-45s more bullish about high street shopping than respondents between 18 and 34.

“46% strongly agreed that local high streets are an important part of British life”

With such a large majority valuing high street shopping and its impact on British culture, coupled with a strong desire to shop in-store, physical stores could witness increased sales this Christmas. Still, although consumers may hold high street shopping close to their hearts, the convenience of online shopping will always be a massive deciding factor, especially while the pandemic continues. In response, retailers would do well to enhance their offline, in-store experiences and integrate them into online customer journeys this year.

Vanessa Flather, Managing Director, Retail, Travel & E-commerce at Webhelp, had this to say of the results:

“The pandemic had a massive impact on the high street, and we expect to see that market trend continue across the Christmas period and into 2022. With this comes an increase in competition between brands online, and a customer base that is increasingly coming to expect high levels of service and convenience.

Innovative retailers will refuse to rely on loyalty alone to drive online sales, and instead focus on creating exceptional customer journeys. Personalisation should be a huge part of this focus – we’re increasingly seeing that customers expect at least some degree of personalisation when they shop, and retailers keen to place themselves ahead of the crowd will look to seize this opportunity.”

At Webhelp, we have a number of solutions to support retailers across the busy festive period and beyond, whether it be personalisation, peak demand management, customer journey optimisation, or analytics–driven customer insights.

If it sounds like we could provide a solution for you, don’t hesitate to get in touch.

![[Fashion] Choosing the right partners to grow your business in 2024, at a time when trust is fragile](https://media.webhelp.com/wp-content/uploads/2023/12/21090253/Office-Showcase-2.png)